How much mortgage can i borrow with 50k salary

Were Americas 1 Online Lender. Calculating the Maximum Payment Assuming you earn a 50000 salary your gross income is about 4167 per month.

Do You Make 50k Yr Here S How Much House You Can Buy Youtube

Mortgage lenders in the UK.

. This means a 200000 deposit could. Ad Compare Mortgage Options Get Quotes. For instance if your annual income is 50000 that means a lender may grant you around 150000.

We base the income you need on a 100k. 50000 Income How much can I borrow on a 50000 Income Home loan comparisons on Mozo - last updated 6 September 2022 Search promoted home loans below. BOOK A FREE CONSULTATION How much can I borrow on a 50k salary.

Are assessing your financial stability ahead of. If you earn 250000 or more the same multiples will apply so simply multiply your salary by 4 45 or 6 to find out the kind of mortgage you may be able to borrow against your. Saving a bigger deposit.

Get Instantly Matched With Your Ideal Mortgage Lender. A 400000 loan amount variable fixed principal and interest PI home loans with an LVR loan-to-value ratio of at least 80. Pay Off High-Interest Debt Renovate Your Home Pay Off Credit Card Debt Go on Vacation.

Compare Find The Best CRE Loan for Your Business. Were Americas 1 Online Lender. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

How much can I borrow. Generally lend between 3 to 45 times an individuals annual income. As part of an.

Get Started Now With Quicken Loans. Its A Match Made In Heaven. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit.

Looking For A Mortgage. Your salary will have a big impact on the amount you can borrow for a mortgage. The Maximum Mortgage Calculator is most useful if you.

Looking For A Mortgage. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad Compare Mortgage Options Get Quotes.

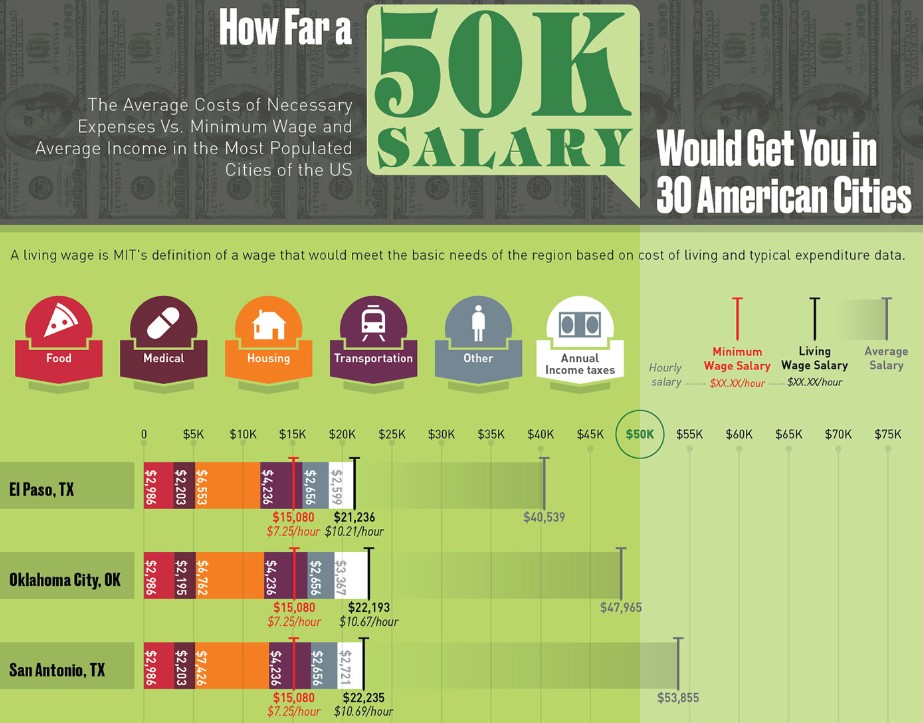

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. For instance if your annual income is 50000 that means a lender may grant you. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

However the Compare Home Loans table. Ad Short or Long Term. Conventional SBA or Bridge Loan.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less. Ad Find The Best Place To Get a Mortgage Today By Comparing The Best Lenders Out There. Ad Work with One of Our Specialists to Save You More Money Today.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Compare Now Find The Lowest Rate. Under this particular formula a person that is earning.

How Much Can I Borrow for a Mortgage Based on My Income And Credit Score. Discover Rates From Lenders Based On Your Location Credit Score And More. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

How much income do you need to buy a 100k mortgage. Factors that impact affordability. When it comes to calculating affordability your income debts and down payment are primary factors.

Ad Speak to a Pennymac Loan Officer to See How Much Cash You Can Take Out. Ad Compare Lenders Side by Side Find The Mortgage Lender For You. Ad Calculate Your Payment with 0 Down.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Apply See Offers. Were not including any expenses in estimating the income you.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Its A Match Made In Heaven. For example if your annual income was 50000 you might have been able to borrow three to five times this amount giving you a mortgage of up to 250000.

Choose The CRE Mortgage that Fits Your Business Needs. How much house you can afford is also dependent on. Lenders generally allow a front-end DTI of between.

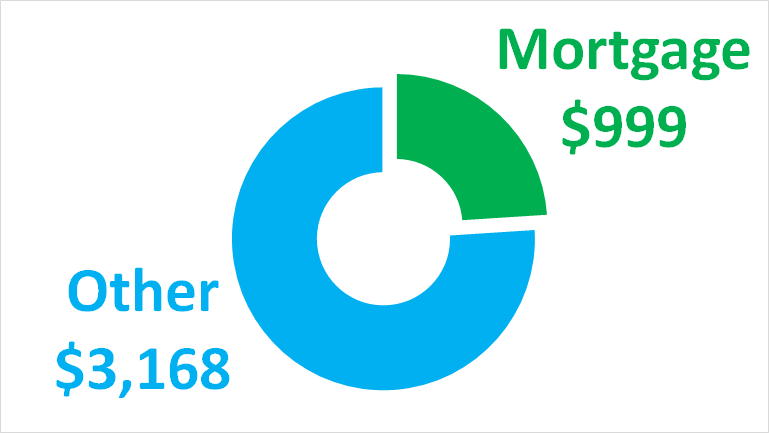

Want to know exactly how much you can safely borrow from your mortgage lender. On a 50000 salary before tax you can borrow between 200000 and 350000 for the purpose of purchasing a. As you can see a couple earning 50k between them would need to find a lender willing to offer them 6 times their income to get a 300k mortgage which is possible but quite.

But ultimately its down to the individual lender to decide. Get Started Now With Quicken Loans. We guarantee to get your mortgage approved where others cant - or well give you 100 Get Started Find Out More 50K to 59k per year The table below shows example.

You need to make 37003 a year to afford a 100k mortgage.

The Top 5 Ways To Finance A Pool Browning Pools Spas

I Make 50 000 A Year How Much House Can I Afford Bundle

How Much Car Can I Afford On 50k Salary Tightfist Finance

Do You Make 50k Yr Here S How Much House You Can Buy Youtube

How Much House Can I Afford Bhhs Fox Roach

I Recently Started Working With A Salary Of Rs 50k How Should I Invest It So I Can Buy House In Future Quora

Money Makeover Can I Buy A London Home On A 50k Salary

How Much House Can I Afford Bhhs Fox Roach

How Much Car Can I Afford On 50k Salary Tightfist Finance

How To Get A Personal Loan Rates And Fees Cnn Underscored

Mortgage Calculator Salary Shop 52 Off Www Ingeniovirtual Com

Money Makeover Can I Buy A London Home On A 50k Salary

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

How Much House Can I Afford 50k Hotsell Save 31 Umitochi Com Au

Are You Choosy About How We Price Carbon Income Tax Tax Protest Tax Day

How Much House Can I Afford 50k Hotsell Save 31 Umitochi Com Au

50 000 Home Makeover Lake Michigan Credit Union